Causal AI in financial markets: Causal drivers of FX Volume

CLS provides granular data on FX transactions, which is fundamental to understanding the investment flow within different currencies.

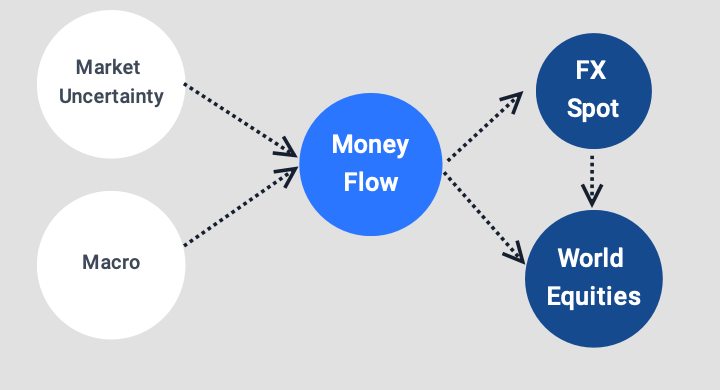

Using the causaLens platform to apply Causal AI in financial markets, we can test a comprehensive library of macroeconomic data for their causal relationships with FX volume. The drivers vary from country to country, ranging from treasury and corporate yields, carry to inflation expectation.

The market uncertainty can be parameterized using a series of factors, such as the VIX, realized S&P volatility, consumer confidence, volatility in commodity prices etc.

Case Study: MXN

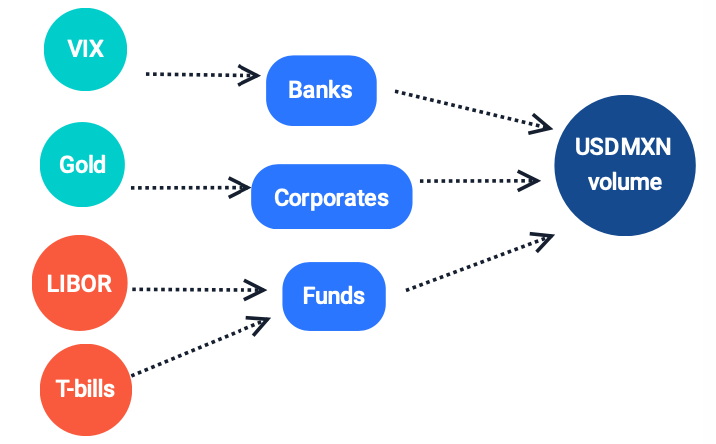

Using CLS data combined with causaLens predictive technology, we are able to pinpoint the causal drivers of USD MXN trading volume for different market participants, shining a light on the trends in macro investor appetite for emerging market risk.

Each type of FX market player has different goals, and so their volumes are driven by different factors.

While banks and buy-side institutions are motivated by market uncertainty, corporates exposed to MXN currency risk watch the gold price as a risk indicator, and funds look at interbank and central bank interest rates to propel their trading strategies.

A global snapshot of uncertainty

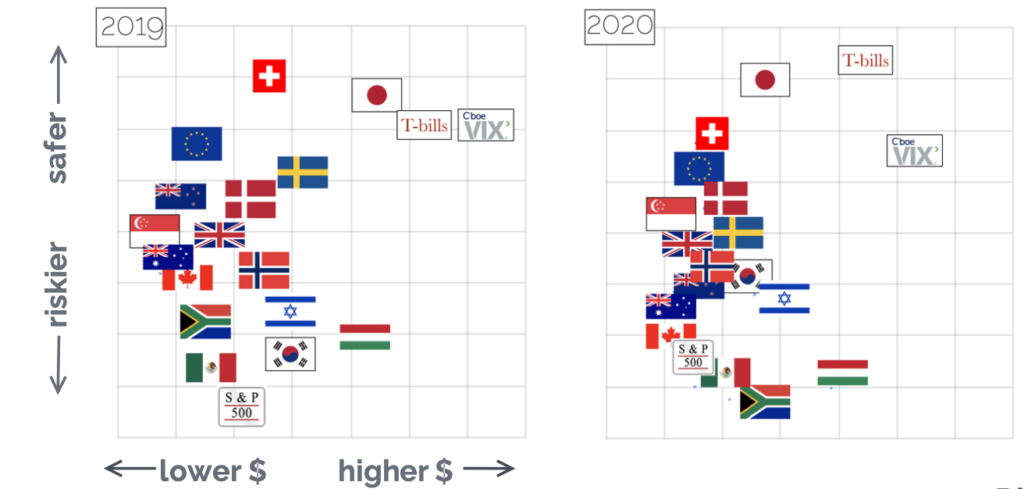

By combining causaLens’ Causal AI in financial markets with CLS data, we are able to build a map of global currencies, understanding which ones benefit in times of uncertainty and which ones are most sensitive to global appreciation of the US dollar.

As the S&P 500 had a historic drop in the first weeks of March, USD gained value against almost all currencies, including the Yen, which is typically dollar neutral. The Korean Won is moving into a relatively safe asset, as it has steadily appreciated following a quick economic recovery.

Risk off

As the uncertainty grows, investors look for safer assets in developed economies, which results in a net flow of capital into countries like the US, Japan and Switzerland.

Risk on

When optimism sets in, the search for yield leads investors to seek riskier assets, which benefits emerging market economies such as Latin America and SE Asia.